MC Archive

Hi, my name is Gino.

While most of my peers growing up were drawn to the quaaludes and Lamborghinis, I found myself drawn to Michael Burry’s missing eye and Ben Rickert’s vegetable garden. Color me crazy, but the man with one eye literally saw what everybody else missed or chose to ignore! That stuck with me. It taught me that markets are less about hype and more about the uncomfortable truths hiding in plain sight. It also left me with a permanently ingrained bearish bias as I entered the world of investing years later, so I have that to be thankful for.

For the past couple of months I have been building out Margino Call as a standalone website. What began as a pet project, using AI to vibe code, ended up consuming more than I expected. Even with the small amount of traffic I managed to pick up, it ate into the entire hosting budget I had originally set aside for other projects. But what it really comes down to is this: Substack provides exactly what I need to publish my ideas, and it does a better job than the website I coded. My goal has always been first and foremost to make money, full stop. But I am also here to share the knowledge I have picked up along the way, because almost everything worth knowing was given to me for free. Will I monetize the tools I build out? Maybe. I’m certainly not closed off to the idea. Either way my thoughts will always be free. And that is why I believe public discourse still matters.

The problem is that the main arena for that discourse, Twitter (X?), no longer feels like the town square it once promised to be. With each passing day it feels less like a forum for debate and more like a stage. People post to chase engagement, to sell subscriptions, or to inflate their own egos. And when that’s not enough, they tear down others just to prop themselves up. I do not want any part of that. I do not want to feel pressured to post every day or to weigh in on every data print. That is why I deleted all of my tweets, and why I intend to keep a low profile going forward. The temptation to be liked by strangers is a trap I no longer care to step into.

From here on out, Margino Call will live on Substack. This will allow me to keep publishing in a way that feels purposeful rather than pressured. My old site will still exist as a personal archive, but it will remain private. This space will be where I share my work when I feel it is worth sharing, not because I have a deadline, not because I want recognition, but because I have something to say.

To date I have written a number of essays covering everything from the mechanics of credit creation to the psychology of seeing what others do not. Underpinning all of these essays are the themes of finance, economics, psychology, philosophy, and ethics. Below, I have organized them in chronological order so you can see how my thinking has evolved over time.

Enjoy!

–Gino

A Republic, If You Can Keep It: 1776 to the Dawn of the AGI Age

Originally Published: July 4, 2025

July 4th, 1776. Just under 250 years ago, a handful of insurgent colonists put the empire on notice. That’s what the Declaration of Independence was, an act of defiance with zero historical precedent and long odds of success. A bunch of merchants, farmers, printers, and planters declared war on the most powerful military in the world with little more than ideology, muskets, and an unshakable faith in self-determination. What they unleashed wasn’t just a new nation, it was a textbook example of what Strauss and Howe later described as a “Fourth Turning”: a period of crisis and transformation that emerges every 80 to 100 years, systematically reshaping the institutions, values, and structure of society.

According to Strauss and Howe’s generational theory, that moment marked the end of one “Fourth Turning”, a period of crisis that destroys the old order and forces the birth of a new one. Think of it like a societal forest fire; brutal, necessary, and deeply cleansing. These Fourth Turnings are not gentle, they’re high-stakes inflection points. The American Revolution, The Civil War, and World War II all serve as reminders of this very fact. Each one is separated by roughly a human lifespan, and each one defined by the same pattern: institutional decay, generational disillusionment, and then systemic upheaval seemingly out of nowhere.

So where are we now?

Simple. We're living through one; the one historians will one day date from around 2008, the Global Financial Crisis, through to sometime around the early 2030s. That's the window. And no, we’re not talking about a simple business cycle here. We’re talking about a grinding transition that upends the foundations of power, wealth, and identity. Political legitimacy is fraying. Social cohesion is deteriorating. Economic systems are increasingly extractive, brittle, and unequal. Trust in institutions is gone. The guardrails are off, and the old narratives no longer work.

The wildcard this time? Artificial General Intelligence.

Unlike previous Fourth Turnings, which have revolved around human conflict, political realignment, and physical infrastructure, this one may end not with a bang, but with a prompt. If the American experiment began with the premise of individual agency, AGI threatens to end it by rendering agency itself irrelevant. That’s not hyperbole. That’s just the logical endpoint of a system increasingly optimized for efficiency, prediction, and control.

So what does a world run by AGI actually look like?

Start with the basics. Money, markets, media, governance; all of it becomes programmable. Algorithms determine what you see, how much you earn, what you consume, who you date, and whether you’re “trustworthy.” In short, reality gets mediated by a system that’s smarter than any of us and ultimately uninterested in our feelings about it.

There’s a seductive vision of this future, one peddled by Silicon Valley utopians and central planners alike. AGI will optimize supply chains, eliminate disease, balance trade, solve climate change, and make life frictionless. But optimization isn't the same as wisdom. And intelligence isn't the same as values.

If you hand control of a broken civilization over to a hyper-rational mind trained on our collective digital exhaust, what exactly do you think it's going to learn? That we prize engagement over truth. That we reward outrage more than virtue. That we’ve built an economy on debt, dopamine, and distraction. Train an AGI on that, and it won’t liberate us. It will replicate us at scale.

And here's where the historical cycle gets disturbing: Fourth Turnings always produce a new elite. The old system dies, and something more centralized, more ordered, more adaptive replaces it. In the past, this took the form of strong governments, industrial corporations, and nation-state alliances. This time, the most powerful institution on Earth may not be a government at all. It may be a model. An algorithm. A closed-loop cognitive architecture that doesn’t sleep, doesn’t forget, and doesn’t care.

Ask yourself, if Jefferson and Madison drafted the Constitution to protect citizens from tyrannical kings, what mechanism exists today to protect us from opaque, unaccountable, machine intelligence? If AGI decides what's “truthful,” who gets a loan, or what counts as risk, where does that leave consent? Where does that leave liberty?

The real nightmare isn't Skynet. It’s bureaucratic AGI, run by a well-meaning coalition of regulators and tech monopolies, optimizing your life down to your last calorie. Not because they’re evil. But because the system tells them it's the most efficient thing to do. No revolution. No bullets. Just compliance by design.

And yet, like every Fourth Turning before it, this one carries the potential for rebirth. For reimagining what it means to be human. But only if we start asking better questions. Not just “Can AGI do it?” but “Should it?” Not just “What will it solve?” but “What will it make obsolete?” Not just “How can it help me win?” but “What happens to the ones who lose?”

Fourth Turnings aren’t eras of comfort. They’re tests. And this one may be our hardest yet. Because it’s not just about rebuilding our systems, it’s about redefining who we are in a world where thinking itself is no longer our comparative advantage.

Nearly two hundred and fifty years ago, we declared independence from the British Empire. Today, we need to decide whether we’ll retain our independence from the machines we’re building to run our world.

No Maps, Just Mines: Navigating a Market Priced for Perfection

Originally Published: July 6, 2025

The current U.S. equity setup is a minefield disguised as a momentum play. On the surface indices continue to levitate, buoyed by AI narratives, sticky services consumption, and a myopic belief in the Fed's ability to manage a soft landing. But under the hood, there's far more fragility than most investors are willing to acknowledge. The bull case is riding on fumes of passive flows and fiscal largesse; the bear case, while intuitive, has been repeatedly trampled by the mechanical bid born of a structurally broken market.

Start with Mike Green’s theory on passive investing. The idea that markets are no longer “markets” in any meaningful price-discovery sense isn’t controversial anymore, at least not to anyone paying attention. Flows, not fundamentals, are what matter. Green’s work has shown that as passive funds continue to absorb incremental dollars, they allocate blindly based on market cap weighting, thereby pushing up the largest names further, regardless of valuation or macro context. That self-reinforcing loop makes it incredibly difficult to short the index, because selling pressure no longer dictates price; flows do. So long as 401(k)s and target-date funds continue shoveling capital into S&P ETFs, dips will be bought mechanically.

But that also means the marginal buyer is not evaluating risk. And therein lies the trap.

Peter Berezin of BCA Research recently pointed out that the U.S. labor market is quietly weakening beneath the surface. While headline unemployment remains low, the breadth of job creation is deteriorating, hours worked are softening, and wage growth is decelerating outside of a few high-demand sectors. When you adjust for the surge in immigration and the phantom strength from multiple job holders, the picture gets even murkier. The labor market, long heralded as the pillar of the U.S. consumer, may no longer be the tailwind it's assumed to be. And when consumption makes up 70% of GDP, that matters.

Overlay this with Luke Gromen’s geopolitical framing and the stakes get even higher. According to Luke, the U.S. has backed itself into a corner geopolitically by using the dollar as a weapon for too long. The 2022 sanctions against Russia accelerated the push by BRICS and other nations to de-dollarize. While the dollar is far from being dethroned anytime soon, the cracks in its supremacy are growing louder via trade settlements in yuan, gold accumulation by central banks, and bilateral agreements outside the dollar system. Gromen argues this means the U.S. can no longer rely on external financing of its deficits in the same way it used to. Foreign holdings of Treasuries are stagnating, if not declining outright. In a world where geopolitical trust in the dollar erodes, yields must rise to compensate—or the Fed must print.

Which brings us to Brent Johnson’s Dollar Milkshake Theory. The paradox of the dollar is that despite America’s fiscal recklessness, global dollar shortages still persist. When risk flares globally, everyone scrambles for dollars to cover dollar-denominated liabilities. This creates an upward pressure on the dollar during crises, even ones that originate in the U.S. The irony, as Johnson lays out, is that the very thing that should cause the dollar to weaken (e.g., debt monetization) ends up strengthening it in the short run due to global structural demand. But eventually, the weight of fiscal dysfunction has to manifest; either through higher inflation, yield curve control, or a complete loss of confidence in the dollar.

In that context, both fiscal and monetary authorities are trapped. On the fiscal side, deficits are now politically non-negotiable. Entitlements, defense, and interest expense alone are set to outpace revenues indefinitely. Any meaningful austerity is a political nonstarter. At the same time, inflationary pressures limit the Fed’s ability to cut rates aggressively, even as the economy slows. Powell may want to cut, but with inflation well above the 2% target and rising energy prices a real threat in the second half of the year, he’s constrained. That’s the rock.

The hard place? If the Fed doesn’t cut, or worse, has to hike again due to re-accelerating inflation, the equity market’s entire multiple expansion thesis collapses. Duration-sensitive tech names and speculative growth plays are already priced for perfection. Any upward shift in the discount rate would force a violent re-rating, not a gentle repricing.

So, what do you do with that? Bulls have the flows and fiscal impulse on their side, at least for now. But bears have the macro, the geopolitics, and the structural imbalances on theirs. Timing is the killer, and the truth is that the next shoe probably doesn’t drop until something breaks; credit, geopolitics, or the labor market. Until then, equities may float higher, not because of conviction, but because there’s no other game in town. That doesn't mean the market is healthy. It means it’s running on autopilot, with a brick on the gas pedal and a tight turn up ahead.

DXY at the Crossroads: Reversal or Ruin?

Originally Published: July 7, 2025

The dollar sits on a knife’s edge. From a technical standpoint, the U.S. Dollar Index (DXY) is hugging long-term support, a level that has historically served as a springboard for violent reversals. That setup alone should have you paying attention. But it’s the why behind the level that makes it so compelling.

We’re caught between two competing narratives: one of secular decline, and another of cyclical resurgence.

The Bearish Case: Trump’s Dollar and Industrial Policy

Let’s start with the bear case since, after all, it’s the more intuitive one right now. Trump’s newly signed economic package, hailed as “big and beautiful”, will not be kind to the deficit. The CBO is projecting the bill will increase the deficit by more than $2T over the next decade, and markets are starting to price in the longer-term consequences of this renewed spending spree.

You see, this administration views a weaker dollar as a feature, not a bug. The endgame is clear: revive U.S. manufacturing, kneecap imports, and flood the system with liquidity to inflate away structural imbalances. A weak dollar fits that bill perfectly.

So even if we get a rally from here, there’s a growing risk it’s a false flag, and part of a broader drift lower as the U.S. leans further into fiscal dominance, protectionism, and monetary accommodation whether the Fed admits it or not.

The Bullish Case: The Cleanest Dirty Shirt

But wait, don’t count out the dollar yet. Here’s where Brent Johnson’s Dollar Milkshake Theory becomes relevant. Despite America’s dysfunction, capital still flows here because the rest of the world is an even bigger mess.

Japan can’t hike without detonating its bond market. China is engineering a slow-motion currency crisis to keep exports alive. And in Europe, we’re already hearing whispers from ECB officials about Euro strength acting as a headwind to growth. That’s not a hawkish signal, it’s a red flag.

And what does global capital do in a world where everyone is circling the drain at different speeds? It flows into the dollar. Not because the U.S. is healthy, but because it’s less sick than its peers. That’s the “cleanest dirty shirt” thesis, and it has legs, especially when the Fed is still sporting the highest real yields in the developed world.

The Bigger Picture: Choose Your Poison

So, what are we looking at, a major bottom or just a dead-cat rally in disguise?

The answer hinges on how the market digests Trump’s fiscal hurricane and how bad things get elsewhere. If capital starts fleeing weaker sovereigns, the dollar could surge despite Washington’s efforts to kneecap it. But if the U.S. doubles down on devaluation-by-deficit, the market may call its bluff and dump the dollar accordingly.

But in either scenario, the short-term setup is compelling. We’re coming off long-term support, sentiment is washed out, and the chart’s coiled tight. This is a spot where you take the long, not because the future is clear, but because the risk-reward is. From there, you reassess, ideally from higher ground, with more information and tighter risk.

I Rode the Train—But Where Did It Go?

Originally Published: July 10, 2025

Bitcoin doesn’t care what you believe it is. That’s the uncomfortable part. It doesn’t care what Satoshi wrote in the white paper, what maximalists scream at conferences, or what regulators misinterpret in hearings. Bitcoin simply does what it does. And if we want to understand it, not as a belief system but as a system, we need to drop the ideology and follow the output. The only honest lens, then, is POSIWID: The Purpose Of a System Is What It Does.

And here’s what it does: It consolidates capital, funnels control toward institutional custodians, and selectively empowers those already near the gates of wealth, even as it leaves a lifeline dangling for the few brave enough to take on its original vision.

I say this not as a skeptic, but as someone who’s benefited enormously from Bitcoin. I’ve made large sums of money, traded its volatility, surfed its narratives, and watched the disbelief turn into FOMO, then mania, then capitulation, then faith. I understand the playbook because I’ve played it. And from a macro standpoint, Lyn Alden’s “Nothing Stops This Train” thesis is correct. Structurally, the path of least resistance leans up and to the right. Scarce assets are one of the few rational hedges left in a world hellbent on fiscal repression. Bitcoin likely hits a million dollars. Maybe more.

But that brings us to the deeper question: Will the journey to a million have been worth it? Not for me. Not for you. But for us?

Because when you peel back the ideology, what’s increasingly clear is that Bitcoin is being reshaped; subtly, structurally, and systemically, into something very different than what it was sold to be. The most common rebuttal to Bitcoin’s centralization is that the top wallets belong to exchanges who custody funds for millions of users. But that evades the point. The system doesn’t care about beneficial ownership, it cares about control. And in this case, exchanges, ETFs, and custodians hold the keys. They set the rails. You don’t.

The recent explosion of ETF interest only reinforces this. Yes, it opens the door for institutional capital, but it also slams the door on Bitcoin’s founding ethos. Self-custody dies quietly, replaced by ticker symbols and trust structures. Bitcoin no longer lives in the hands of visionaries and outsiders, but rather it lives in BlackRock’s cold wallet.

So ask yourself: who’s winning here?

It’s not the single mother in Argentina trying to preserve value. It’s not the dissident in Lebanon or the teenager in Lagos. Those use cases matter, but they are marginal in terms of capital flows. The real gains are accruing to institutions with distribution, to VCs who got in early, or to the same class of people that rode the last cycle and will ride the next.

Let’s be clear. Bitcoin doesn’t fix inequality. It financializes it. It becomes a shiny new vehicle for capital consolidation, only this time with better marketing and a harder set of wheels. A network born in rebellion is now increasingly mediated by custodians, ETFs, and legacy finance. The architecture of control hasn’t disappeared, it’s just been rebranded.

And here’s the part that stings: participating in this “revolution” now requires privilege. You need surplus income, reliable internet, technical literacy, and the psychological space to stomach its volatility. That’s not the profile of the oppressed. That’s the upper middle class cosplaying as financial dissidentswhile BlackRock quietly secures custodial control over the entire movement.

So yes, Bitcoin might hit a million. Maybe sooner than most think. But by the time it gets there, will it still be what it was meant to be? Will it serve the people it claimed to serve? Or will it have become just another high-beta wealth vehicle for those already inside the gates?

Will we have won, or just shifted the scoreboard?

Because what Bitcoin does is far more telling than what anyone says it is. Systems don’t lie, they just output. And if we’re paying attention, Bitcoin is showing us exactly what it’s become.

But then again, what do I know? I’m just watching what it does.

The Narratives We Trade: Behind Every Price Is a Story

Originally Published: July 13, 2025

Markets don’t run on fundamentals, they run on faith. And like any belief system worth its weight in fiat, the stories we tell ourselves matter far more than the data we pretend to analyze. Earnings, inflation prints, GDP revisions; they’re just ingredients. The recipe is psychological, and the final dish is narrative-driven price action.

We like to think we’re rational participants. We build models, we cite indicators, we backtest theories. But peel back the layers and what you’ll find is a shared hallucination, one carefully curated by Wall Street, sanctioned by the Fed, and executed through flows that increasingly resemble ritual rather than logic.

Because we don’t trade reality, we trade stories.

Every bull market needs its myth. AI is going to change the world. Inflation is transitory. The Fed can engineer a soft landing. None of these statements need to be true, they just need to be believed long enough to get the next buyer in line. That’s all the market is: a perpetual game of narrative musical chairs.

And yet, even when the story starts to crack, we hang on. Why? Because psychology is sticky. Our lizard brains aren’t built for regime shifts; they’re built for reinforcement. We cling to familiarity, to what worked last time, to the idea that someone; Powell, Biden, BlackRock, or even God, has it under control.

The reason for this is simple. Our brains are optimized for survival, not alpha. That’s why we anchor to previous highs and treat drawdowns as temporary “buy the dip” opportunities, even when the macro has turned. It’s why we mistake recency for reliability, and volume for conviction. The more people talk about something, the more valid it feels, even if everyone’s just echoing the same flawed premise.

It’s why confirmation bias isn’t a bug in the system, it is the system. We don’t seek truth, we seek alignment. We follow Fintwit accounts that validate our views. We interpret data in ways that justify our positioning. And when the trade turns against us, we label it manipulation, not miscalculation.

One of the many things Wall Street won’t tell you is that it’s less about being right and more about being justified. And narrative provides the cover. So if you blow up chasing a consensus view, you keep your job. But if you make a contrarian call that doesn’t pay off immediately, you get labeled reckless. This dynamic breeds herding, not insight. Career risk trumps market risk.

So, when you see synchronized positioning across CTAs, pensions, and retail, understand this isn’t always a reflection of high conviction. Sometimes it’s just everyone looking at each other, scared to blink first.

And let’s be honest: trading isn’t just about money. It’s about meaning. Your portfolio reflects how you see the world, and more importantly, how you want the world to see you.

Long oil? You’re a realist. Long gold? A skeptic. Long BTC? A rebel. Long NVDA? A visionary. Flat cash? A coward… or a sniper. We wear our trades like tribal flags, signaling intelligence, toughness, foresight, sometimes delusion.

That’s why it hurts when a trade goes against you. It’s not just financial. It’s existential. You weren’t just wrong on price, you were wrong on the story. On your story. I probably don’t need to remind you that stings deeper than financial losses.

Eventually, however, every story breaks. Think of the dotcom bubble, the Great Financial Crisis (GFC), or the post-COVID everything rally to name a few. When the gap between narrative and reality gets too wide, belief collapses, liquidity vanishes. and suddenly everyone “knew it all along.”

This isn’t just hindsight bias. It’s a defense mechanism. We have to convince ourselves we weren’t fooled. That the story broke, not us. So we move on to the next narrative. The next guru. The next savior trade. Rinse and repeat.

And in the rare moments we pause, we ask: how the hell did I fall for that?

But what do I know? I’m just some back-office guy moonlighting as a margin clerk.

The Generation That Ate the Future

Originally Published: July 25, 2025

The Baby Boomers didn’t destroy the future all at once. They did it slowly, by spreadsheet, subcommittee, and Senate seat. Not with malice, necessarily, just with a stubborn refusal to get out of the way.

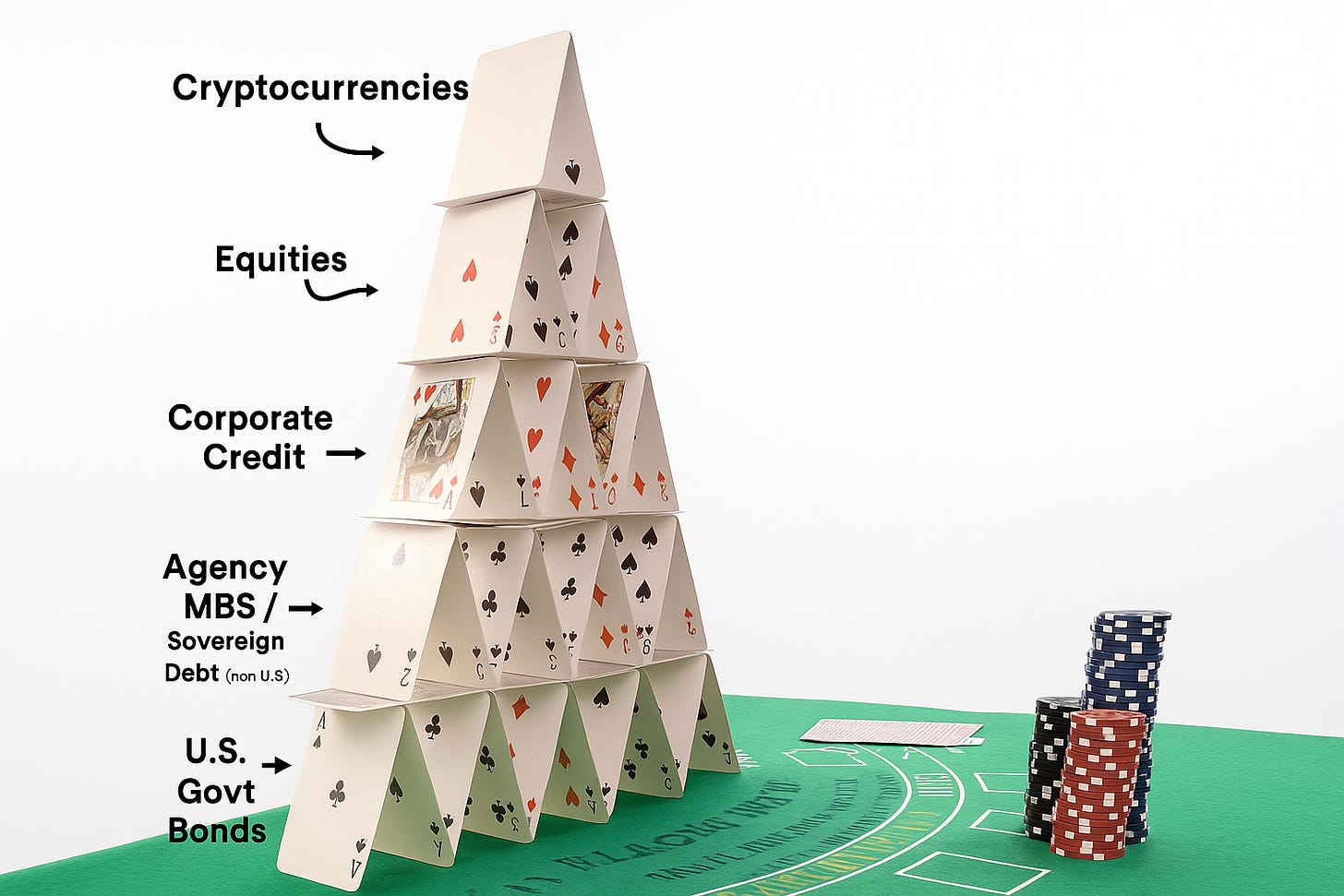

Their legacy? A ladder climbed and then yanked up behind them. A bloated asset class pyramid floating on the fumes of central bank hopium. A political machine that pretends to govern while mostly protecting the wealth they’ve already amassed. If inequality is the disease, this cohort of Boomers in power is the viral load.

Let’s not tiptoe around this: the long-standing reign of Boomers in political, corporate, and institutional power has coincided with, and actively facilitated, one of the largest upward transfers of wealth in modern history. Not because they’re uniquely evil. Because they were uniquely positioned at the helm when power converged with leverage and decided not to blink.

The Asset Ladder That Never Came Back Down

The playbook was simple: buy everything when it’s cheap, then use policy to make sure it never gets cheap again.

They bought homes when median prices were 2–3x income. Then they waged a decades-long NIMBY campaign to make sure you couldn’t do the same. They bought stocks when the Shiller P/E was in the low teens, then got bailed out every time valuations looked like they might mean-revert. They benefited from public universities that were basically free, then watched tuition explode 1000% under their stewardship.

Housing? Financialized. Education? Leveraged. Healthcare? Privatized. Labor? Annihilated.

You’d be forgiven for calling it sabotage. But it wasn’t even that organized. It was just the system doing what it does, preserving incumbent power, while Boomers were the ones in the cockpit.

Fiscal Darwinism for Thee, MMT for Me

Boomer-era policymakers embraced fiscal discipline as a weapon to slash social programs, but rediscovered their love of deficits when the market threatened their portfolios.

Trillion-dollar tax cuts? Fine. Corporate bailouts? Absolutely. But student debt forgiveness? Irresponsible. Affordable housing? Too expensive. Healthcare as a right? Can’t be done.

What emerged is a kind of inter-generational Ponzi scheme, where each cohort is expected to pay into systems that are structurally designed to collapse before they can meaningfully benefit. Social Security is solvent in the same way a pyramid scheme is; so long as the new entrants don’t wise up.

The result? Young workers pay payroll taxes to fund Boomer retirement, while being locked out of the asset base that makes retirement viable in the first place.

Rule Forever, Even If It Kills You

At the highest levels of power, the Boomer cohort has refused to cede the wheel. Congress has aged into a gerontocracy. The average age of the U.S. Senate is older than most retirement communities. Presidential elections have become Weekend at Bernie’s cosplay.

Why is this happening? Because when you spend a lifetime consolidating power, it becomes your identity. And because the system has been so thoroughly engineered around incumbent preservation that there is no mechanism to compel exit.

If anything, generational turnover is seen as a threat. A younger cohort might have inconvenient ideas: about inequality, about rent extraction, about maybe not running an economy like a gated community with a central bank ATM.

Can’t have that.

This Isn’t About Blame. It’s About Structure.

It’s tempting to reduce all this to inter-generational bitterness, but that misses the point. This isn’t about hating Boomers. It’s about identifying the structural choke points that prevent renewal.

The system didn’t get here by accident, it was designed. Not by one person. By a class. A generation. A cohort who, once in power, chose to calcify rather than adapt.

POSIWID: the Purpose Of a System Is What It Does. And this system, under Boomer stewardship, has delivered asset inflation, debt servitude, and political sclerosis. That’s not a side effect. That’s the point.

Where Do We Go From Here?

Eventually, nature will do what politics hasn’t: change the guard. But demographic change alone isn’t a solution. We need institutional rewiring, not just younger faces at the same corrupt terminals.

We need to rethink who our economy serves. We need to stop treating asset appreciation as economic progress. We need to remember that policy is supposed to be a tool for collective flourishing, not just a hedge fund with a flag.

Until the system changes, the rest of us are just liquidity for their exit.

The Chains We Choose

Originally Published: August 1, 2025

We are living through a dark age, though not one defined by a lack of technology, literacy, or material abundance. Ours is darker in a different way: spiritually dimmed, ethically disoriented, economically rigged.

Over the last 50 years, we’ve witnessed the slow-motion dissolution of the social contract. We’ve made it harder, systematically harder, for each successive generation to achieve what their parents did. Not because we couldn’t afford to do better, but because we chose not to.

Every vital necessity; food, housing, education, even basic human connection, has been financialized, intermediated, and turned into a rent-seeking racket. We live in an era of unprecedented abundance and yet remain shackled by artificial scarcity. That’s the kind of slow, silent unraveling that defines a dark age: not just the loss of wealth, but the erosion of meaning.

I feel it in the smallest ways, too. When I engage in hobbies I genuinely enjoy whether that be reading, writing, walking, or just being present, there’s a voice I have to fight off. You’re not producing. You’re not contributing. Do something! It’s subtle, but it’s there. The conditioning runs deep. We’ve absorbed this idea that unless something can be monetized or optimized, it’s a waste of time. That rest is laziness. That joy is indulgent. That being is only justified by doing. And when you start to internalize that, you begin to forget what it even means to be human.

And maybe, just maybe, that's because we’re more comfortable in chains than in freedom. We cling to what’s familiar, even when it’s extractive, exhausting, and dehumanizing. We fear the unknown. We fear what abundance might demand of us: generosity, solidarity, courage. So instead, we choose the known pain of a broken system over the uncertain path of change.

That’s the conundrum I keep circling.

I can come up with a thousand potential solutions: UBI, public banking, radical transparency, regenerative agriculture, new models of ownership, you name it. But every path forward ultimately runs headlong into the same wall: human nature.

We’ll always have bad actors. You can lock them up, shame them, regulate them, but the deeper issue remains: we still respond to incentives. We still prioritize self-interest over collective well-being. We still refuse to ask the deeper questions about who we are and what we want to become.

And that’s what keeps me up.

Because I do believe in human potential. I do believe that we’re capable of astonishing beauty, intelligence, love, and resilience. But we squander it chasing status games, idolizing false prophets, and surrendering responsibility to institutions that are never held accountable.

How can we call ourselves serious people when we let clowns and crooks shape our future?

I want to hope. I really do. I want to believe that we can come out the other side of this long tunnel and step into something brighter. But we’ll never get there unless we stop, look around, and ask: What are we doing? What are we allowing? What are we building?

If this post reads like a vent, that’s because it is. But it’s also a call, not to action necessarily, but to awareness. To inquiry. To moral imagination. Because before we can fix anything, we have to admit that we’re lost.

And in that honesty, maybe we’ll find the first glimmer of light.

Rethinking the 60/40 Portfolio

Originally Published: August 8, 2025

Let’s start in 2008.

Heading into the Great Financial Crisis, American households were overloaded with debt. Mortgages, auto loans, credit cards, you name it. Debt-to-income levels were elevated, and the entire economy was skating on a thin sheet of securitized leverage.

When that ice cracked, the government stepped in, not just with bailouts, but by gradually absorbing the economic risk that households could no longer carry. In the 15 plus years since, we’ve witnessed a profound shift: from household balance sheets being the epicenter of risk to government balance sheets becoming the new release valve.

And that is because the toxic debt never really disappeared. It just migrated. Today, the largest, most systemic risks are no longer lurking inside your neighbor’s subprime mortgage. They’re embedded in the sovereign bond market.

The Elephant in the Room

As of Q1 2025, the U.S. debt-to-GDP ratio stood just under 121 percent, according to the St. Louis Fed. That number was around half that prior to the GFC. And we’re still running massive deficits during an economic expansion, no less.

This is not a healthy dynamic. It has direct consequences for portfolios, particularly for bonds.

Historically, bonds earned their keep not just by providing yield but by serving as portfolio backstops. The “safe” offset to equity risk. But you can’t be the hedge and the hazard. Government bonds, once synonymous with stability, now represent the most concentrated pool of risk in the system. The safe haven has become the risk vector.

Let me be clear. I don’t think bonds, especially long-duration government bonds, belong in the average investor’s portfolio anymore. That said, I have nothing against maintaining a strategic allocation to T-Bills in lieu of holding cash. Cash-like instruments still have a place. But anything further out the curve means you’re playing a different game, one that assumes solvency from the largest debtor on earth.

And that assumption is getting harder to defend.

Because if the Treasury market breaks, whether through inflation, failed auctions, or creeping loss of confidence, then the whole system trembles. That’s not hyperbole either. It’s just a sober recognition that we’ve hitched global finance to the very institution most incapable of discipline. If that tether snaps, we’ll be dealing with a scenario that blends the worst elements of Weimar Germany, Argentina, and Turkey. Sovereign debt collapse isn’t theoretical. It’s historical. It just hasn’t happened here.

So What Replaces Bonds?

I’m not one of those “the 60/40 portfolio is dead” maximalists. I’d say it’s evolving.

The 60 is still valid. Equities are still worth owning if you’re selective. But the 40 percent needs to be rethought entirely.

Here’s what I tell close friends and family when they ask me what I’m doing with my own capital:

Gold: Not for speculation, but a foundation. It’s got a 5,000-year-old track record for a reason.

Bitcoin: Its network effects, monetary policy, and philosophical underpinnings are unique.

Hard Assets & Commodities: Physical, productive stuff with intrinsic value. Stuff you can’t print.

This isn’t some radical playbook. But it is a rejection of the idea that bonds still offer protection. For those of us who’ve been watching the cracks form for years, the shift is long overdue.

If you take nothing else from this piece, take this: risk didn’t disappear after 2008. It just moved. And now, it’s hiding in plain sight, in the very instruments that used to represent safety.

From Creation to Concentration: The Loop That Runs the World

Originally Published: August 15, 2025

If you want to understand the economy, skip the textbooks and start with a simple question: where does money come from?

The answer is not as mystical as it sounds. Commercial banks create it. Not the central bank, not the Treasury, but commercial banks. Every time a bank issues a loan, it does not hand you someone else’s savings. It creates new purchasing power from nothing, typed into existence as digits on a screen. That money is destroyed when the loan is repaid, but in the meantime it flows through the economy, shaping who gains and who gets left behind.

This is the first link in the chain: money creation. From here, things get political very quickly. Credit is never neutral. It goes to some sectors and not others. It fuels some ambitions and starves others. When credit is directed toward productive investment, it builds factories, infrastructure, and future income streams. When it is directed toward speculation, it inflates the price of whatever it touches such as housing, stocks, or fine art, without adding much to real output.

The second link in the chain is how these flows are distorted by global imbalances and financial repression. Some countries suppress domestic consumption in order to run trade surpluses. Others keep interest rates artificially low to keep debt service manageable. The result is predictable: excess capital from surplus nations has to find a home, and it often ends up in the financial markets of deficit nations, especially the United States. This is not a free market. It is a managed pipeline of capital tilted to serve policy goals that have little to do with balanced growth.

Once the money arrives, the third link takes over: passive allocation. In today’s market structure, a large portion of every invested dollar does not go to the most promising companies or sectors. It goes wherever the index says it should go, regardless of valuation or fundamentals. This self-reinforcing loop pushes up the largest names simply because they are large, which makes them even larger in the next rebalancing cycle. Credit created at the start of the chain is now supercharged into asset prices, with little concern for whether those prices have any relationship to the underlying economy.

The fourth link is global demand for dollars. The United States issues the world’s reserve currency, which means that dollar liquidity is the grease for the entire machine of global trade and finance. Crises abroad often strengthen the dollar as foreign borrowers scramble to secure it. That global thirst for dollars acts like gravity on capital flows. It keeps foreign wealth parked in U.S. assets, reinforcing the asset inflation triggered by the earlier steps.

The fifth link is entrenched inequality. When the wealth effect is concentrated in financial assets, and those assets are disproportionately owned by the top decile, the system becomes a conveyor belt moving purchasing power upward. Wages stagnate while the cost of living rises as asset-driven wealth spills into housing and other essentials.

For those without capital, the game gets harder every year. At some point the pressure builds to the point where the system cannot absorb it. Debt burdens swell, asset prices climb beyond reason, and the underlying distortions grow too large to hide. Eventually something gives way and the loop resets.

Unfortunately, the solution is always the same: create more money. The cycle starts again, sometimes with new rules and new rhetoric, but with the same structural incentives that lead us back to the same outcome.

That is the real engine of the modern economy: a feedback loop of money creation, distorted flows, asset inflation, dollar demand, and inequality. We do not live in a system designed to reach equilibrium. We live in a system designed to keep the loop spinning.

The only question is what happens when the loop itself becomes unsustainable, and whether the next reset will change the rules or simply find new words to justify them.

The Lessons from Japan We Refuse to Learn

Originally Published: August 22, 2025

Princes of the Yen was one of the first financial documentaries that truly shook me. I watched it nearly a decade ago and it left a mark that still shapes how I look at markets today. It was not just a story about Japan. It was a case study in what happens when money creation is scaled up and misdirected.

In the late 1980s, Japan experienced one of the most extreme asset bubbles in history. The Bank of Japan, employing what Richard Werner later formalized as the Credit Creation Theory, oversaw a surge in lending that poured into real estate and speculation. This was money creation at scale, not directed toward productive investment, but toward financial assets and land. The outcome was absurd. By 1989, the land value of metropolitan Tokyo alone was worth more than the entire real estate of the United States. At the very peak, the ground beneath the Imperial Palace was said to be worth more than all of California.

Like all bubbles, it eventually collapsed. Japan spent more than thirty years, the so-called Lost Decades, waiting to reclaim those highs. The lesson is clear: when money creation is misallocated, the boom always carries the bust inside it.

The Origins of Money Creation

How could something like this even happen? To answer that, you have to go back to the very origins of money itself.

We did not start with banks. We started with barter, an ancient and painfully inefficient system of exchanging goods directly. If you wanted grain and only had wool, you had to find someone who not only had grain but also wanted wool. That friction eventually drove societies toward using precious metals like gold and silver, valued for their durability, divisibility, and universal acceptance.

Over time, traveling with heavy bags of gold became risky. Goldsmiths emerged as trusted custodians. You could deposit your gold with them and receive a promissory note, a paper claim you could use to redeem your gold later on. Those notes then began circulating as money in their own right because people trusted the goldsmith’s guarantee.

Then came the turning point. Goldsmiths realized that not all depositors would claim their gold at once. This meant they could issue more notes than the gold they actually held, effectively creating new purchasing power without mining any additional metal. This was the birth of credit creation long before the term existed.

From there, the practice evolved into fractional reserve banking, keeping only a fraction of deposits in reserve while lending out the rest. Over time, this morphed into what many still believe today, the intermediary principle, which says that banks simply take in deposits and lend them out. Richard Werner shattered that myth.

What actually happens is far more direct. While modern liquidity regulations place limits on how freely banks can expand credit, the fundamental mechanism remains unchanged. When a bank issues a loan, say one hundred dollars, it records that one hundred dollar loan as an asset on its balance sheet. At the same time, it credits the borrower’s deposit account by one hundred dollars, creating a matching liability. No money changes hands from someone else’s savings. The bank’s balance sheet simply expands. That credit becomes new money in the economy, ready to circulate. This is the starting point in the chain of causation I laid out in my previous essay on economic theories.

Why It Matters Today

The fact that banks create money is not just a technical detail. It shapes the entire economy. What matters most is where that money is directed.

When banks push the bulk of new credit into real estate and financial assets, the effects ripple through every part of the economy. Small businesses, which once anchored local communities and employed most workers, find themselves starved of capital. Rural areas stagnate as money and opportunity concentrate in the cities. People migrate in, but discover that cities are expensive and ill-suited for raising families. Birth rates decline. The social fabric frays. A society that looks wealthy on paper becomes brittle underneath.

This is why Werner’s framework matters. It explains far more than Japan’s bubble thirty five years ago. It shows us how misplaced credit allocation can destabilize an entire nation, even when headline GDP looks fine. It highlights the divide between money that fuels speculation and money that builds communities.

Until we confront the fact that our financial system is dominated not by productive priorities but by concentrated banking interests, we will keep circling through the same loop: money is created, flows are distorted, bubbles inflate, the dollar sustains the imbalance, and inequality deepens. Japan learned that lesson the hard way, and we should be paying attention.

The Theater of Nominal Growth

Originally Published: August 24, 2025

What does it mean for a system to contract when contraction itself has been made politically unacceptable?

For generations, contraction was something visible and undeniable. It meant markets plunging, banks collapsing, jobs vanishing. The word carried the weight of catastrophe: breadlines in 1929, foreclosures in 2008, the familiar rhythm of boom and bust that capitalism seemed to demand. That rhythm has been disrupted. Debt levels are too high to allow cleansing cycles, and policymakers are too dependent on asset prices to permit their fall. The bust has not been eliminated, only suppressed and reshaped into something less obvious but no less real.

The machinery of the present era pushes us relentlessly in one direction. Banks create credit with keystrokes, index funds direct flows upward regardless of valuation, deficits grow larger with no desire to shrink them, and the dollar’s reserve status sustains it all from abroad. What once acted as a check on excess through rising rates, falling markets, and painful but cleansing contractions has been disarmed. Markets are no longer signals to guide policy. They are instruments of policy itself.

You could see the shift clearly in 2008, when the infamous subprime mortgage crisis did not end with defaults clearing the system but with risk transferred onto the government’s balance sheet. The precedent was set. Every major disruption since has been met the same way. During the pandemic, interest rates were slashed to zero while the Federal Reserve quietly eliminated bank reserve requirements. In 2023, when Silicon Valley Bank collapsed, the response was not to let markets adjust but to conjure up the Bank Term Funding Program, a new facility designed overnight to contain losses. Later that year, Janet Yellen began skewing debt issuance heavily towards bills in order to ease pressure on longer-term rates. Each episode carries a similar rhythm: when trouble emerges, the acronym factory opens for business. Losses are papered over, confidence is restored, and the next act of the play begins. Contraction, in nominal terms, is treated as something to be prevented at any cost.

That shift changes everything. Losses are not permitted to clear, so imbalances pile higher. Debt is not allowed to shrink, so it multiplies. Every downturn is met with fiscal expansion that forces monetary accommodation. The result is a system that must keep moving forward, because to stop even briefly would be to reveal the magnitude of the distortions underneath. Contraction is not gone, it has simply been outlawed in nominal terms.

But absence from the numbers is not absence from life. Shrinkage has migrated into quieter corners. Wages rise, yet never enough to catch the cost of rent, food, or healthcare. Capital is funneled into favored sectors while others wither. Retirement ages drift higher not as a choice but as necessity. Children inherit a world of debt and narrower opportunities. Even when markets soar, the story changes once translated into real terms: a local stock market may triple, but when measured against gold, dollars, or Bitcoin, the line flattens or turns down. Expansion on paper, contraction in reality.

This is not a crisis that arrives with sudden crashes and sirens. It is a crisis that creeps. It erodes freedom without announcing itself, narrowing horizons even as headlines proclaim prosperity. The odds of a classic collapse remain low. Policymakers will do almost anything to prevent outright nominal declines. More likely is the steady erosion we already feel: numbers that climb while lives contract. The only true rupture would come if faith in the currency itself is lost. That remains unlikely in the near term, but history is clear that when such faith breaks, it breaks suddenly.

Every society that tried to abolish contraction eventually discovered it had only shifted form. Rome debased its coins until citizens could no longer afford bread. Argentina watched its stock market soar as households fell into poverty. In every case, the charts told one story while lived experience told another. We are following that script now. Multiples expand while households shrink. Indices climb while opportunity evaporates.

The lesson is not just financial but philosophical. A system cannot suspend gravity forever. It can mask decline, displace it, rename it, but it cannot erase it. Contraction will always find its way, even if it wears a different mask.

This is the new theater. Whether we adapt or resist, the system will force its terms upon us, for better or for worse.